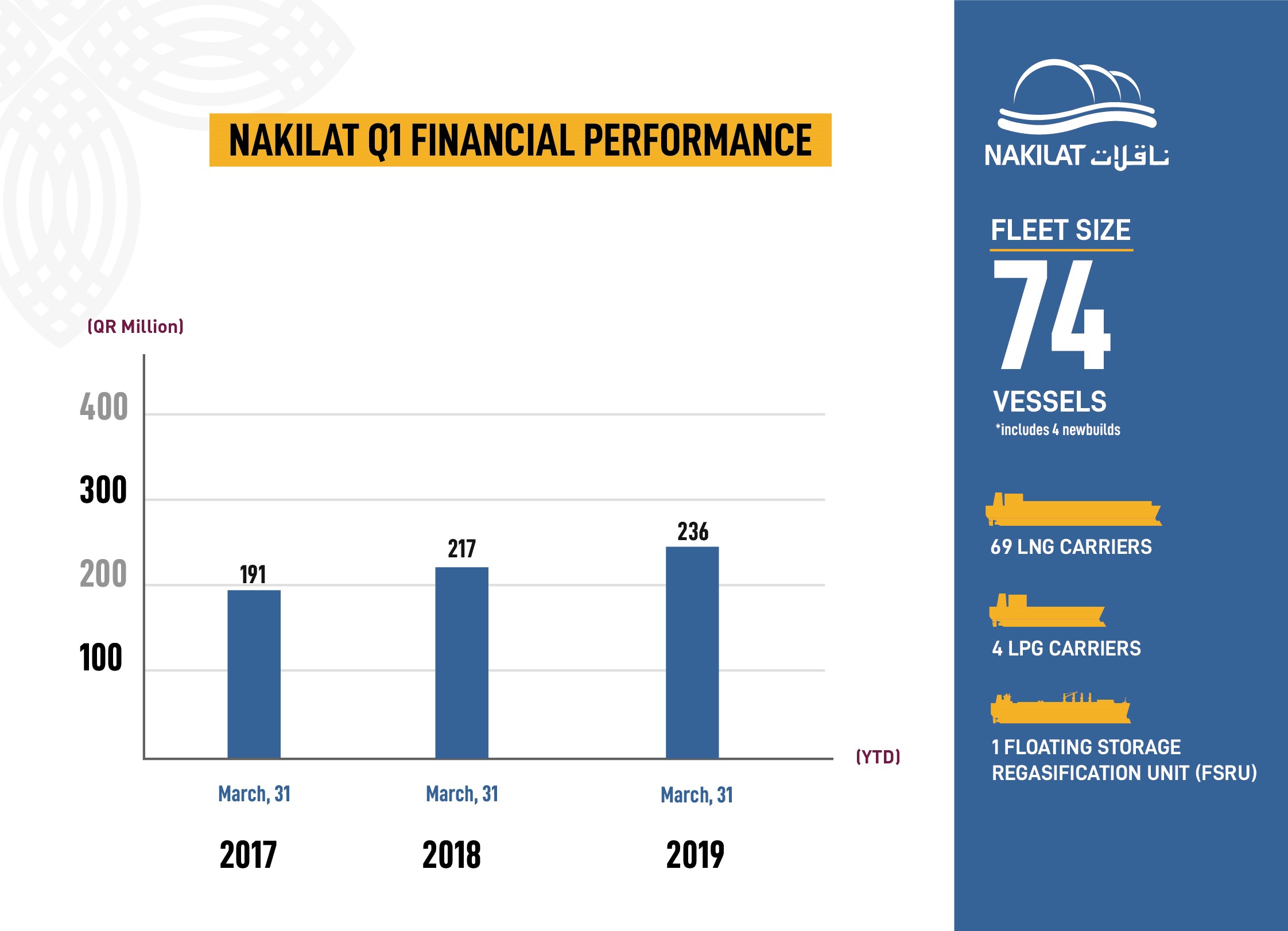

Nakilat reports QAR 236 million profits for the first quarter of 2019, a 9% increase

21 April 2019

Nakilat announced its financial results for the first quarter ended March 31, 2019 with a net profit of QR 236 million compared to QR 217 million of the same period last year in 2018, with an increase of 9%. This increase was mainly due to the acquisitions of two Liquefied Natural Gas (LNG) carriers and one Floating Storage Regasification Unit (FSRU) in 2018, and higher volume of projects at Nakilat’s ship repair facility. The achievement of positive results across its operations is also attributed to the rationalization of operational expenses and enhanced operational efficiency.

Nakilat successfully deployed the company’s strategic plans towards maintaining its global leadership in LNG transportation and the integral role it plays in Qatar’s LNG supply chain. The company has managed to grow its international portfolio through the recent expansion with Maran Gas Ventures Inc. to include four additional LNG carriers, demonstrating the enhanced operational efficiency and financial strength of the company. With 4 LNG vessels under the new JV, the number of Nakilat’s vessels has increased to 74, accounting for approximately 11.5% of the global LNG fleet in carrying capacity.

Nakilat continues to support development of local enterprises in a bid to strengthen local supply chain within the energy and maritime industry. During Qatar Petroleum’s Localization Program for Services and Industries in the Energy Sector “TAWTEEN”, which was held on 18th, February 2019, Nakilat signed an agreement with McDermott to form a joint-venture (JV) company providing offshore and onshore fabrication services in Qatar. This project will provide a range of new services that will support Nakilat and its joint ventures to undertake the construction, maintenance, repair and refurbishment of offshore and onshore structures, and all types of vessels.

Nakilat’s Board of Directors commended the company’s solid financial results and operational performance, which bears testament to its resilience and prudent strategic efforts towards maintaining its leadership in the global energy transportation market, as well as supporting Qatar’s ambition to be the top exporter of LNG. Complemented by strategic long-term agreements with well-established charterers and its own determination to operate sustainably, Nakilat has managed to maintain steady cashflow and generate positive value for its shareholders. The Board also noted the company’s continued excellence in health, safety and environmental management, with a higher benchmarked average safety record compared to other companies operating in the same industry. Nakilat’s commitment to cybersecurity compliance was also highlighted as the company takes necessary measures to ensure the reliability of its operations and business continuity.